Indirect Taxes

- An indirect tax is paid on the consumption of goods/services

- It is only paid if consumers make a purchase

- It is usually levied by the government on demerit goods to reduce the quantity demanded (QD) and/or to raise government revenue

- Government revenue is used to fund government provision of goods/services e.g education

- Indirect taxes are levied by the government on producers. This is why the supply curve shifts

- An indirect tax can be either ad valorem or specific

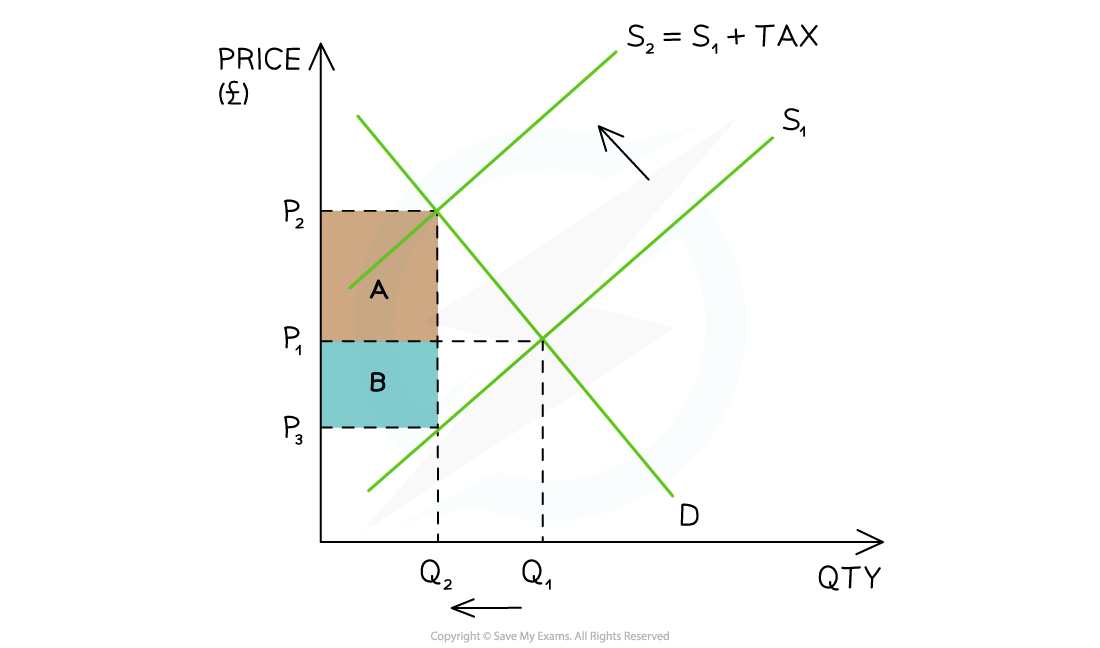

1. A Specific Tax

- A specific tax is a fixed tax per unit of output (specific amount) e.g. $3.25/packet of cigarettes

The impact of an indirect tax is split between the consumer (A) and the producer (B)

Diagram Analysis

- Initial equilibrium is at P1Q1

- The government places a specific tax on a demerit good

- The supply curve shifts left from S1→S2 by the amount of the tax

- The price the consumer pays has increased from P1 before the tax, to P2 after the tax

- The price the producer receives has decreased from P1 before the tax to P3 after the tax

- The government receives tax revenue = (P2-P3) x Q2

- Producers and consumers each pay a share (incidence) of the tax

- The consumer incidence (share) of the tax is equal to area A: (P2-P1) x Q2

- The producer incidence (share) of the tax is equal to area B: (P1-P3) x Q2

- New equilibrium is at P2Q2

- Final price is higher (P2) and QD is lower (Q2)

- If the decrease in QD is significant enough, it may force producers to lay off some workers

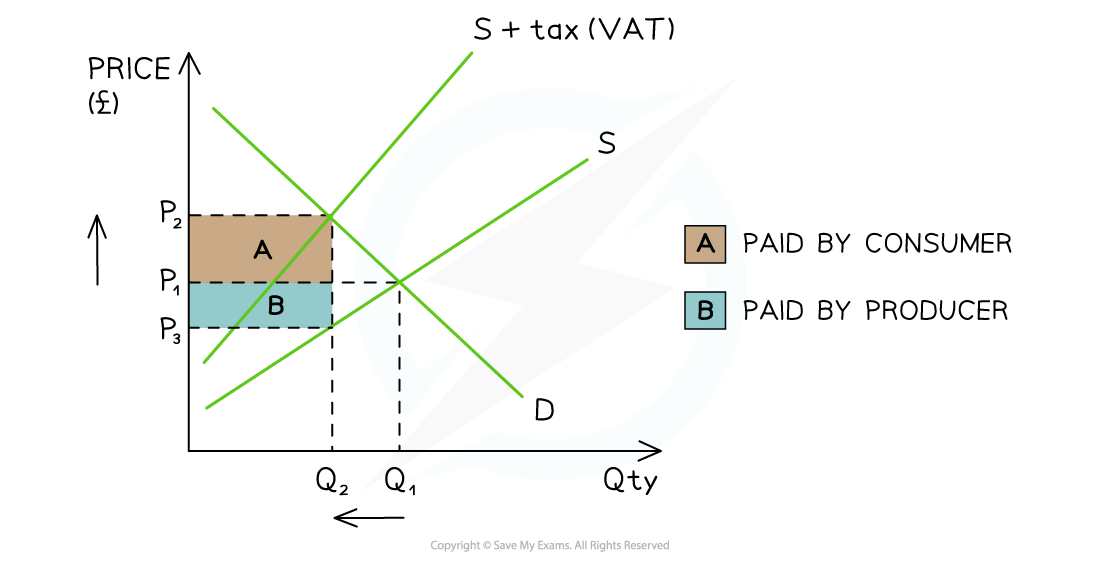

2. Ad Valorem Tax

- A tax that is a percentage of the purchase price e.g. Value added tax (VAT) in Columbia in 2022 was 19%

- The more goods/services consumed, the larger the tax bill

- This causes the second supply curve to diverge from the original supply curve

- VAT raises significant government revenue

A diagram showing an ad valorem tax (VAT) and the tax incidence for producers and consumers

Diagram Analysis

- Initial equilibrium is at P1Q1

- The government places an ad valorem tax to raise government revenue

- Supply shifts left due to the tax from S → S + tax

- The two supply curves diverge as a percentage tax means more tax is paid at higher prices

- Supply shifts left due to the tax from S → S + tax

- The price the consumer pays has increased from P1 before the tax, to P2 after the tax

- The price the producer receives has decreased from P1 before the tax to P3 after the tax

- The government receives tax revenue = (P2-P3) x Q2

- Producers and consumers each pay a share (incidence) of the tax

- The consumer incidence (share) of the tax is equal to area A: (P2-P1) x Q2

- The producer incidence (share) of the tax is equal to area B: (P1-P3) x Q2

- New equilibrium is at P2Q2

- Final price of goods/service is higher (P2) and QD is lower (Q2)

- If the decrease in QD is significant enough, it may force producers to lay off some workers

Exam Tip

When drawing this diagram, students often find it hard to identify the three price points.

The tax incidence boxes are formed by drawing the new equilibrium quantity through the original supply curve. The three price points are the old equilibrium point, the new equilibrium point - and where the new quantity crosses the original supply curve.

Irrespective if you are dealing with taxes or subsidies, always use the new equilibrium point to determine your incidence boxes.

The consumer incidence is paid from the consumer surplus area and the producer incidence is paid from the producer surplus area.

An Evaluation of Indirect Taxes

The Advantages and Disadvantages of Indirect Taxes

Advantages |

Disadvantages |

|

|

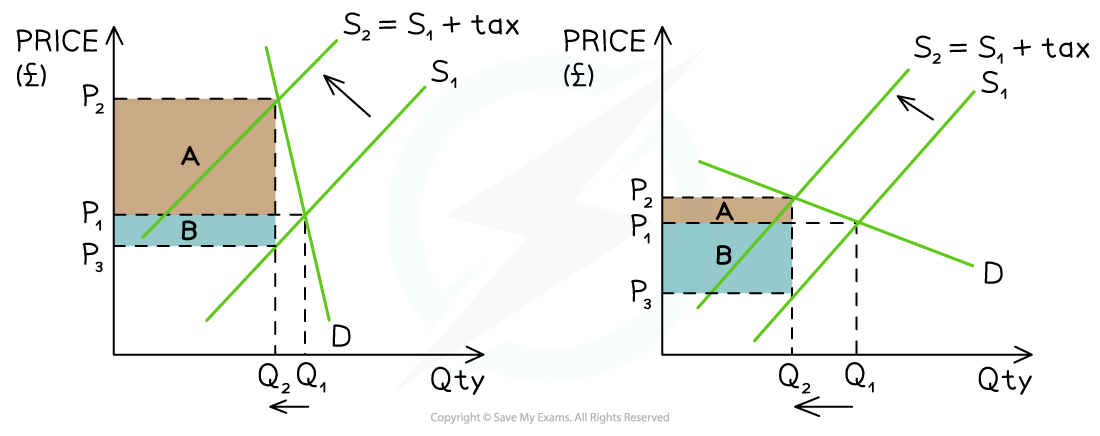

A side by side Comparison of the Impact of PED on Tax Incidence

- Aiming to maximise their profits, producers pass on as much of the indirect tax as they can to consumers and pay the balance themselves

- The amount passed on to consumers depends on the price elasticity of demand (PED) of the product

A diagram that demonstrates the tax incidence for a product whose PED is inelastic (left) and elastic (right). A is the consumer incidence and B is the producer incidence

Diagram Analysis

- In both diagrams

- The specific tax shifts the supply curve from S1→S2

- There is a higher market price at P2 and lower QD at Q2

- Tax revenue for the government is the sum of A+B

- Consumer incidence is represented by A and producer incidence by B

- Total revenue for the seller is calculated using P3 X Q2

- The difference in PED results in a different steepness to the demand curve

- For an inelastic product (e.g. cigarettes)

- The curve is steep

- Producers pass on a much higher proportion of the tax to consumers (A) and pay the rest themselves (B)

- The QD decreases (Q1→Q2) but by a much smaller proportion than the increase in price (P1→P2)

- For an elastic product (e.g. pizza)

- The curve is much flatter

- Producers pass on a much smaller proportion of the tax to consumers (A) and pay the rest themselves (B)

- The QD decreases (Q1→Q2) but by a much larger proportion than the increase in price (P1→P2)

Exam Tip

When asked to evaluate the impact of a tax in a particular market, it is essential to apply knowledge of PED to the impact it will have on producers, consumers and the government.

It should be obvious from the context if the product in question is elastic or inelastic in demand. If not, work through the factors that determine PED and make a judgement as to whether the product is elastic or inelastic in demand. In your answer, explain your reasoning.

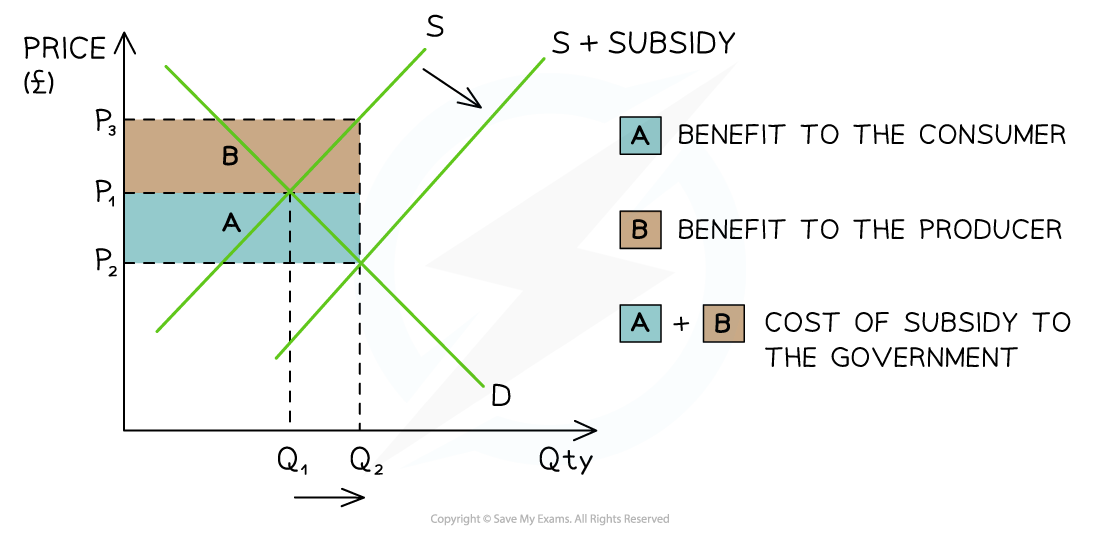

Subsidies

- A producer subsidy is a per unit amount of money given to a firm by the government

- To increase production

- To increase the provision of a merit good

- The way a subsidy is shared between producers and consumers is determined by the price elasticity of demand (PED) of the product

- Producers keep some of the subsidy and pass the rest on to the consumers in the form of lower prices

A diagram which demonstrates the cost of a subsidy to the government (A+B) and the share received by the consumer (A) and producer (B)

Diagram Analysis

- The original equilibrium is at P1Q1

- The subsidy shifts the supply curve from S → S + subsidy

- This increases the QD in the market from Q1→Q2

- The new market equilibrium is P2Q2

- This is a lower price and higher QD in the market

- Producers receive P2 from the consumer PLUS the subsidy per unit from the government

- Producer revenue is therefore P3 x Q2

- Producer share of the subsidy is marked B in the diagram

- The subsidy decreases the price that consumers pay from P1 → P2

- Consumer share of the subsidy is marked A in the diagram

- The total cost to the government of the subsidy is (P3 - P2) x Q2 represented by area A+B

Exam Tip

Memorise the distinction below as students get very confused when answering questions on subsidies.

When dealing with a subsidy, the producer benefit is now the top portion of the incidence area and consumer incidence is below. This can be confusing as in all other diagrams, it is the other way around (surplus, indirect tax etc.)

Logically, it makes sense. Producers are given an extra amount of money for each unit by the government so this raises the sales revenue they receive, while at the same time lowering the price consumers pay.

An Evaluation of Subsidies

The Advantages and Disadvantages of Producer Subsidies

Advantages |

Disadvantages |

|

|