An Introduction to Fiscal Policy

- Fiscal Policy involves the use of government spending and taxation (revenue) to influence aggregate demand in the economy

- Fiscal policy can be expansionary in order to generate further economic growth

- Expansionary policies include reducing taxes or increasing government spending

- Expansionary policies include reducing taxes or increasing government spending

- Fiscal policy can be contractionary in order to slow down economic growth or reduce inflation

- Contractionary policies include increasing taxes or decreasing government spending

- Contractionary policies include increasing taxes or decreasing government spending

- Fiscal Policy is usually presented annually by the Government through the Government Budget

- A balanced budget means that government revenue = government expenditure

- A budget deficit means that government revenue < government expenditure

- A budget surplus means that government revenue > government expenditure

- A budget deficit has to be financed through public sector borrowing

- This borrowing gets added to the public debt

Sources of Government Revenue

- The main sources of government revenue include taxation, the sale of goods/services by government owned firms, and the sale of government owned assets (privatisation)

1. Taxation

- Direct taxes are taxes imposed on income and profits

- They are paid directly to the government by the individual or firm

- E.g. Income tax, corporation tax, capital gains tax, national insurance contributions, inheritance tax

- E.g. Income tax, corporation tax, capital gains tax, national insurance contributions, inheritance tax

- They are paid directly to the government by the individual or firm

- Indirect taxes are imposed on spending

- The supplier is responsible for sending the payment to the government

2. Sale of goods/services

- Government owned firms sometimes charge for the goods/services that they provide

- E.g. Charges on public transport and fees paid to access some medical services

- E.g. Charges on public transport and fees paid to access some medical services

3. The sale of government owned assets

- Privatisation can generate significant government revenue during the year in which the government sells the asset

- Most assets can only be sold once e.g. national airlines or railways

- Some assets, such as the right for mobile phone operators to use the airwaves, can be sold every few years (the airway license is for a defined period of time)

Government Expenditure

- Government expenditure represents a significant portion of the aggregate demand in many economies. The expenditure can be broken down into three categories

- Current expenditures: These include the daily payments required to run the government and public sector. E.g. The wages and salaries of public employees such as teachers, police, members of parliament, military personnel, judges, dentists etc. It also includes payments for goods/services such as medicines for government hospitals

- Capital expenditures: These are investments in infrastructure and capital equipment. E.g. High speed rail projects; new hospitals and schools; new aircraft carriers

- Transfer payments: These are payments made by the government for which no goods/services are exchanged. E.g. Unemployment benefits, disability payments, subsidies to producers and consumers etc. This type of government spending does not contribute to aggregate demand as income is only transferred from one group of people to another

The Goals of Fiscal Policy

- Fiscal policy is used to help the government achieve their macroeconomic objectives

- Specifically, the use of fiscal policy aims to

- Maintain a low and stable rate of inflation

- Maintain low unemployment

- Reduce the business cycle fluctuations

- Create a stable economic environment for long-term economic growth

- Redistribute income so as to ensure more equity

- Control the level of exports and imports (net external balance)

- When a policy decision is made, it creates a ripple effect through the economy impacting the macroeconomic objectives of the government

- Changes to fiscal policy can influence several of the components of AD

- A change to any component of AD helps to achieve at least one of the goals of fiscal policy

Expansionary & Contractionary Fiscal Policy

1. Expansionary Fiscal Policy

- Expansionary fiscal policies include reducing taxes or increasing government spending with the aim of increasing AD

- AD= household consumption (C) + firms investment (I) + government spending (G) + exports (X) - imports (M)

- AD = C + I + G + (X - M)

- AD = C + I + G + (X - M)

- Expansionary fiscal policy aims to shift aggregate demand (AD) to the right

Classical diagram illustrating expansionary fiscal policy which increase real GDP (Y1 →Y2) and average price levels (AP1 →AP2)

Diagram Analysis

- The economy is initially in macroeconomic equilibrium AP1Y1 - there is a recessionary gap

- The Government is wanting to boost economic growth and lowers the rate of income and corporation taxes

- Lower taxes cause investment and consumption to increase which are components of AD

- Aggregate demand increases from AD→ AD1

- The economy reaches a new equilibrium at AP2Y2 - a higher average price level and a greater level of national output

Examples of the Impact of Expansionary Fiscal Policy

Example 1: The Government decreases corporation tax |

|

|

Effect on the economy |

Firms net profits increase → investment by firms increases → AD increases |

|

Impact on macroeconomic aims |

|

Example 2: The Government increases unemployment benefits |

|

|

Effect on the economy |

Household income increases → consumption increases → AD increases |

|

Impact on macroeconomic aims |

|

2. Contractionary Fiscal Policy

- Contractionary fiscal policies include increasing taxes or decreasing government spending with the aim of decreasing AD

- AD= household consumption (C) + firms investment (I) + government spending (G) + exports (X) - imports (M)

- AD = C + I + G + (X - M)

- AD = C + I + G + (X - M)

- Changes to fiscal policy can influence government spending or consumption or investment

- Changing taxation can influence household consumption and the investment by firms

- Changing taxation can influence household consumption and the investment by firms

- Contractionary fiscal policies aims to shift aggregate demand (AD) to the left

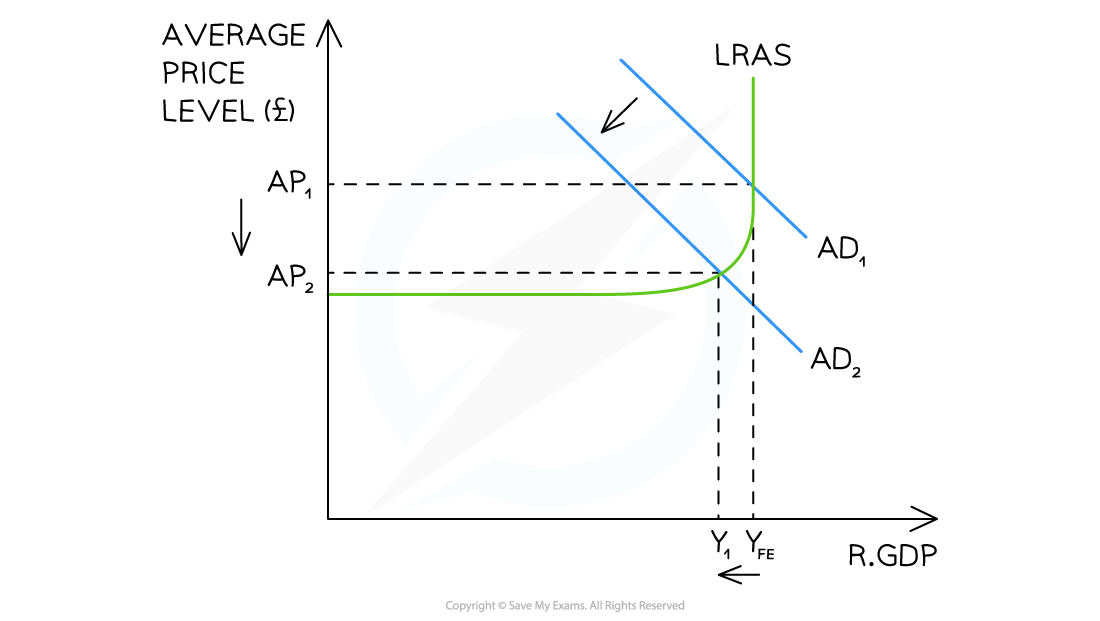

Keynesian diagram illustrating how a contractionary fiscal policy aims to decrease real GDP (YFE →Y1) and average price levels (AP1 →AP2)

Diagram Analysis

- The economy is initially in macroeconomic equilibrium AP1YFE - an inflationary output gap is developing

- The economy is booming and the Government is wanting to lower inflation towards its target of 2%

- The Government increases the rate of income tax

- Higher tax rates cause households to have less discretionary income causing consumption to decrease

- Aggregate demand decreases from AD1→ AD2

- The economy reaches a new equilibrium at AP2Y1 - a lower average price level and a smaller level of national output

Examples of the Impact of Contractionary Fiscal Policy

Example 1: The Government increases the rate of income tax |

|

|

Effect on the economy |

Households pay more tax → discretionary income reduces → consumption reduces → AD reduces |

|

Impact on macroeconomic aims |

|

Example 2: The Government freezes/reduces public sector workers pay |

|

|

Effect on the economy |

Wages stagnate or reduce → Consumer confidence falls → consumption decreases → AD decreases |

|

Impact on macroeconomic aims |

|

Example 3: The Government cuts Government Spending in their Budget |

|

|

Effect on the economy |

Less demand for goods/services → less income for firms → output and profits decrease → AD decreases |

|

Impact on macroeconomic aims |

|

An Evaluation of Fiscal Policy

Strengths of Fiscal Policy

- Spending can be targeted at specific industries

- It can be highly effective in restoring confidence in an economy during a deep recession

- Redistributes income through taxation

- Reduces negative externalities through taxation

- Increased consumption of merit/public goods

- Short term government spending can lead to an increase in the aggregate supply of an economy

- E.g. Building a new airport immediately increases government spending and AD, but when it is built, the potential output will have increased (Production Possibility Curve has shifted outward)

Weaknesses of Fiscal Policy

- Political pressures: Policies can fluctuate significantly when new governments are elected

- Long term infrastructure projects may lack follow-through

- Long term infrastructure projects may lack follow-through

- Unsustainable debt: Increased government spending can create budget deficits which are added to the national debt

- Repaying this debt may lead to austerity on future generations

- Repaying this debt may lead to austerity on future generations

- Conflicts between objectives

- E.g. Cutting taxes to increase economic growth may cause inflation

- E.g. Cutting taxes to increase economic growth may cause inflation

- Time lags: It is difficult to predict exactly when the desired effect on the economy will occur. Fiscal policy also takes a longer time to plan and implement than monetary policy

- Government budgets are usually presented once a year whereas monetary policy adjustments can take place 4-8 times per year